Ignore the Financial Noise

How in the world do I stay focused on long-term investing goals with all the noise around me? And how do I avoid chasing the hot ideas of the day when all my friends and colleagues are telling me how much money they are making in the stock market.

Well, here’s a little secret…most of them are exaggerating or conveniently forgetting the losers in their portfolio.

I’ve seen so many portfolios, especially with folks in technology, that are filled with the “hot tech names” we’ve all heard on CNBC over the past couple of years. As a result, these portfolios lack adequate diversification.

Many great fortunes have been built by taking huge risks, betting everything on a business venture or working for the “right company” in the early days with equity compensation that paid off in a big way. But for every one of those stories, there are thousands of others who went broke betting too much on a single company, industry, or idea.

Diversification is not just a buzz word; it’s an essential element of building and sustaining wealth over the long term.

So, back to my initial question: How do we stay focused on long-term investing goals with all the financial noise and conflicting information around us? Well, it can be difficult, especially when you have colleagues and neighbors telling stories of the big profits they’ve made trading stocks and implementing complex “investment strategies.” The problem with putting your faith in those stories is that you are likely only getting a small part of the bigger picture. In other words, you are only hearing about the winners…and never about the losers.

Picking winners in the stock market and profiting on short-term trades are extremely difficult even for professional money managers. For every trade you make, there is someone else on the other side of that trade who is betting in the opposite direction. And more times than not, it’s a professional money manager on the other side of the trade with a team of research analysts solely focused on separating you from your money.

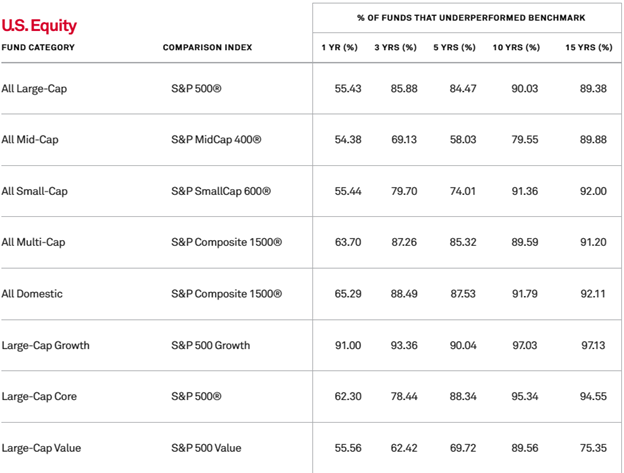

Do you know how many active mutual fund managers actually outperform their benchmark? It’s less than 10% in most categories over the last ten years. THAT’S FEWER THAN ONE IN TEN ACTIVE FUND MANAGERS WHO OUTPERFORM THEIR BENCHMARK FOR TEN YEARS OF MORE! If the professionals can’t do it, what chance do you and I have?

Here are some stats from SPIVA:

And consider this…most of what individual investors target for trading are large-cap growth stocks. ONLY 3% OF ACTIVE LARGE-CAP GROWTH FUND MANAGERS OUTPERFORMED THEIR BENCHMARK OVER THE LAST TEN YEARS!

Again, if the professionals can’t beat “the market,” what chance do you and I have? I would say we have very little chance.

And why risk it? A globally diversified portfolio of stocks and bonds invested for the long-term, along with a savings rate of around 25% depending on individual circumstances, is all most of us need to achieve financial freedom.

Ignore the noise, smile at your stock trading co-workers, and just keep dollar-cost-averaging into your diversified portfolio in your 401k, HSA, Roth IRAs, and taxable brokerage accounts if applicable. If you do that, you will likely come out far ahead of those who chase the hot stock tips of the day (and love talking about their “winners”).

Editorial Team

How Advice-Only Financial Planning Can Help You Achieve Your Retirement Goals in Cumming, GA

How Advice-Only Financial Planning Can Help You Achieve Your Retirement

The Benefits of Hourly Financial Planning: How It Works for You

The Benefits of Hourly Financial Planning: How It Works for

Small Business Finance with Hourly/Advice-Only Financial Experts

Small Business Finance with Hourly and Advice-Only Financial Experts Facebook

Inflation and Its Effects on Fee-Only Financial Plans

Inflation and Its Effects on Fee-Only Financial Plans Facebook Twitter