Comprehensive Risk Management for High-Net-Worth Individuals

High-net-worth individuals face unique challenges in risk management due to

Have you ever sat down and tried to figure out how much money you’ll need for a retirement that could last thirty years or more? I’m guessing if you’re reading this article, you have likely given it some serious thought. And if you’re anything like me, you’ve probably created a dozen different spreadsheets over the years trying to figure out when you might reach that magical state of financial independence.

What level of retirement savings made you think, “hmm…if I could just get to $X, I’d be set.” Was it $1M? $2M? $5M? What was your number based on? Did you hear folks talk about “the four percent rule” and back into the amount of retirement savings you would need? Did you factor in inflation? What about medical expenses? Long-term care? Would you like to maintain your pre-retirement standard of living (or even exceed it)? Spreadsheets and financial calculators are great for calculating the future value of your retirement portfolio, but if you failed to adjust for inflation or include a reasonable estimate for medical and long-term care expenses in your calculations, you could be way off on what it will actually take to maintain your living standard in retirement.

Let’s analyze some data based on a few very general assumptions around current savings, income, spending, and taxes to see if we can draw some meaningful conclusions that will help you determine if you are saving enough. These are very general assumptions for simplicity. Every situation is unique and far more complex. This post should not be taken as financial advice, and if you do plan to seek help from a financial advisor, The Motley Fool has a great slideshow with some questions to ask a potential advisor. I’ve attempted to answer a number of these questions on my FAQ page.

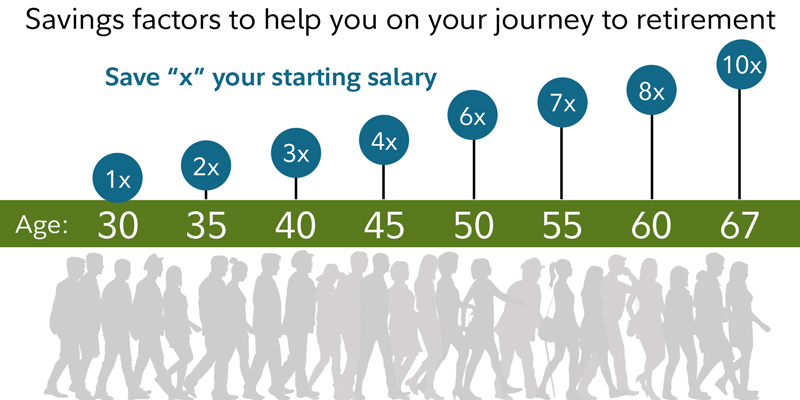

If you browse the web and social media, you will find endless “guidelines” on how much you should have saved for retirement by certain ages. These numbers are so generic that they are almost meaningless outside the context of your specific goals and needs; however, we do need to use some sort of assumption as a starting point for our illustrations. So, I will use Fidelity’s guidelines around how much one should have saved for retirement at certain ages to complete our analysis.

Fidelity gives us the following guidelines around how much you SHOULD have saved up for retirement at certain ages:

We will use Fidelity’s chart above as a starting point for calculating how much more you would need to save in order to maintain your pre-retirement standard of living.

We will look at a thirty-, forty-, and fifty-year-old couple, all earning $150k per year in total household income with the Fidelity-recommended retirement savings already saved up.

NOTE: These asset allocations are for illustration purposes only and should not be assumed appropriate for your situation. Your risk tolerance and risk capacity are unique to your specific circumstances and should be discussed with a financial planner prior to implementation. The return assumptions are based on historical returns in the context of a diversified portfolio of global stocks and bonds and are in no way guarantees or predictions of future returns.

The projections used in the illustrations below are based on RightCapital’s financial planning software, which is part of the tech-stack we use and make available to our clients as their financial planning hub.

Let’s start with the 30-year-old couple earning $150k in combined gross income. Both spouses have a 401k with their current employer, and both contribute up to the match of six percent. The company kicks in 50% of that first six percent, or 3% of their salary. For our illustration, we will include the company match in the savings amount.

Assuming the couple works to age 65, let’s take a look at how close the six percent savings rate (9% total savings rate with the company match) gets them to a pre-retirement level of spending.

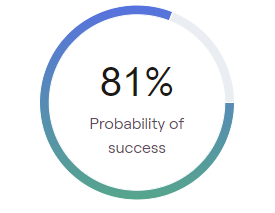

For a 30-year-old couple earning $150k per year with $150k already saved for retirement, saving 6% in their 401k, getting the 3% match from their employers, and maxing out Roth IRA’s should be sufficient to achieve a pre-retirement lifestyle throughout a 30-year retirement starting at age 65. Monte Carlo analysis gives this couple an 81% chance of success (with success being the likelihood of not running out of money by age 95). Simply saving up to the match in the 401k plans and maxing out Roth IRA’s, this 30-year-old couple would be saving $25.5k, or 17% of their gross income. But remember, this couple already has $150k in retirement savings by age 30. The required savings rate would be much higher with a lower starting portfolio.

Now let’s take a look at a forty-year-old couple with a household income of $150k and current retirement savings of $450k (3x current income). For this couple, it will take an 8% 401k deferral plus the 3% company match along with maxing out Roth IRA’s ($12k total) to get to an 80% probability of success. So, our 40-year-old couple with 3x their income already saved would need to save $28.5k or 19% (including the company match) to have a reasonable chance of not running out of money throughout a 30-year retirement.

For our 50-year-old couple with $900k already saved up for retirement, it would take an 8% 401k deferral, plus the 3% company match, and the max plus catch-up of $7k contributed to each of their Roth IRA’s to get to an 80% chance of success, according to our Monte Carlo analysis. That’s annual savings toward retirement of $30.5k, or 20% of their gross income.

Just for fun, let’s look at two additional scenarios for the 50-year-old couple. Independently, let’s see what effect changing the current savings and changing the savings rate has on the probability of being able to maintain their pre-retirement lifestyle throughout retirement.

As you can see, falling behind on your retirement savings during the accumulation phase can have a devastating impact on your post-retirement lifestyle!

Assume you and your spouse are retiring today with a final pre-retirement income of $150k and expected Social Security payments totaling $50k, annually. Let’s further assume that the often-quoted rule of thumb that you will need “80% of your pre-retirement income in retirement” applies to your situation (implying that you will need $120k in annual pre-tax income in retirement). It would take a $1.75M portfolio to produce the additional $70k in annual income needed, assuming a beginning withdrawal rate of four percent. If your plan is to retire earlier than your Social Security full retirement age, you would likely need to start with a withdrawal rate below four percent.

And remember, you will need to factor inflation into your calculations. If your plan is to retire ten years from now, with annual inflation of 2.5%, that $120k spending level would grow to $154k ($64k being SS and $90k coming from your retirement savings). In other words, at 2.5% annual inflation, it will take $154k ten years from now to buy the same goods and services that $120k buys today. And that implies a $2.25M portfolio.

Were you planning to retire at age 55? You might want to think about starting with a more conservative 2.5% or 3% withdrawal rate given the additional years your portfolio will have to support you. And at age 55, you won’t have Social Security to help offset those portfolio withdrawals. If you need $120k annually to retire at 55 and maintain your lifestyle, you will need a retirement portfolio of at least $4M in today’s dollars at a 3% withdrawal rate. And given you will be pulling the entire $120k out of your retirement savings in the early years prior to starting Social Security, 2.5% might be more appropriate…and that implies a $4.8M portfolio at age 55.

Just winging it is a dangerous proposition that could leave you having to drastically adjust your lifestyle in retirement. Saving 6% in your company 401k plan will not likely produce a retirement nest egg large enough to maintain your pre-retirement standard of living. A savings rate closer to the 15-20% range will be required throughout your working years if you want to approximate your pre-retirement spending in your retirement years. And the earlier you start, the easier it will be. If you’ve fallen behind and are now in your forties or fifties, it is certainly not too late, but time is of the essence. You will need a deliberate and disciplined plan to make up for the lost years of compounding.

If this topic interests you, and you’d like to chat about it, feel free to reach out or simply schedule some time on my calendar. I love to talk about personal finances, and if I can help you in the process, I consider that time well spent.

High-net-worth individuals face unique challenges in risk management due to

An error occurred while generating the blog post about Are

Expertise in Local Tax Regulations One of the primary advantages